Former Fed chief warns that the housing market will continue to weaken but says sector has already posted its sharpest decline.

November 6 2006: 4:43 PM EST

WASHINGTON (Reuters) -- The U.S. housing market will weaken further, but the sharpest decline is over as inventories of unsold homes decrease, former Federal Reserve Chairman Alan Greenspan said on Monday.

"This is not the bottom, but the worst is behind us," Greenspan said at a conference organized by financial services firm Charles Schwab.

Greenspan retired from the U.S. central bank in January, but his comments have still had the power to move financial markets.

A decline in U.S. home sales and construction has contributed to an overall slowing of economic growth to 1.6 percent in third quarter. But Greenspan said housing market activity is likely no longer to be a drag on overall economic growth as unsold inventories clear out and stabilize against sales levels.

The slowdown has hurt profits and sales for the nation's major homebuilders, including Pulte Homes (up $0.08 to $30.18, Charts), Centex (Charts), D.R. Horton (Charts), Lennar (Charts), K.B. Home (Charts) and Toll Brothers (Charts).

Fed policy-makers are watching closely to see if the slowdown in the economy will ease a little of the worrisome upward pressure that a tight labor market has been exerting on prices. Fed officials have said they are confident the housing slowdown has not spread into other areas of the economy and that slightly higher rates of growth will return in 2007.

Hopes for Fed rate cuts die

The former central banker said he is "reasonably confident" the United States will not slide into recession because businesses appear to be strong, as evinced by strong corporate profit margins and healthy levels of capital investment.

Greenspan, whose every move as Fed chairman was scrutinized for clues about monetary policy and the economic outlook, laid to rest the legend that Fed interest rate decisions could be divined by how full his briefcase appeared to be when he went to work.

"The extent to which my briefcase was fat or thin depended on whether my wife had time to make me lunch," he said.

On interest rates, the former Fed chair cautioned that global factors that helped push down long-term interest rates, fueling the U.S. housing boom of the early part of the decade, are not permanent features of the economic landscape.

Greenspan once famously described the phenomenon of stubbornly low long-term interest rates, despite the Fed's steady increases in short-term benchmark rates, as a conundrum.

On Monday, he said that forces such as a flood of new workers into the world economy after the collapse of communism and the global integration of China were one-time events that will eventually stop playing a role in keeping long-term interest rates as persistently low.

"There is a turning point but I don't know where it is," he said.

Your New York Broker

Wednesday, November 08, 2006

Might Have to Wait til 2008 to Relax

High-End or Starter Homes, Builders Remain in a Slump

By EDUARDO PORTER

Published: November 8, 2006

Two of the nation’s major home builders reported dismal results in their most recent quarters yesterday, confirming that the slump in the once-hot housing market is far from over.

Toll Brothers, the country’s largest builder of luxury homes, said revenue from home building fell 10 percent, to $1.81 billion in its fourth quarter, ended Oct. 31, compared with $2.01 billion in the period a year earlier. The results are preliminary; the company will report earnings on Dec. 5.

Toll Brothers’ backlog of projects declined 25 percent and its signed contracts plunged 55 percent as the company suffered from a rash of cancellations concentrated in the formerly hot markets of Florida and Northern California.

“I don’t think we can call where the floor is,” said Joel Rassman, chief financial officer of Toll Brothers. “We have not seen a turnaround yet.”

The decline was not limited to the luxury segment of the housing market. The Atlanta-based Beazer Homes USA, a smaller rival that builds many homes for first-time buyers, reported that net income fell 44 percent, to $91.9 million, or $2.19 a share, in the quarter ended Sept. 30, from $164.4 million, or $3.61 a share, in the period in 2005.

Revenue increased 4 percent, to $1.88 billion. But new orders plummeted 58 percent, and the company forecast a substantial decline in earnings for 2007.

More than a year into a housing market bust, the home builders’ deteriorating fortunes are hardly a surprise. In September, sales of both new and existing homes were running around 14 percent below their level a year earlier.

Home prices have not fallen uniformly across the nation; in some areas, they have, however, declined steeply. By September, the average price of a newly built home was about 2 percent below the price of a year earlier, according to government figures.

Stuck with unsold inventory that is the equivalent of more than six months of sales, builders have slammed on the brakes. New-housing starts in September were running about 18 percent below their level in September 2005.

Toll Brothers, which is based in Horsham, Pa., cut its forecast for home deliveries in 2007 by 9 percent to 10 percent, compared with its previous forecast. And it trimmed its portfolio of land to 74,000 lots, 19 percent below its high in the fiscal second quarter, which ran from February through April.

James O’Leary, chief financial officer at Beazer Homes, said the company reduced its number of lots by 15 percent in the quarter. It also cut about 1,000 jobs in September and October, about 25 percent of the company head count.

The slump in construction has hurt the broader economy. Residential investment, which accounts for about 5 percent of the nation’s total economic production, plummeted 17.4 percent in the third quarter of the year, according to government data. It was the biggest quarterly decline in more than 15 years, single-handedly reducing the growth in gross domestic product by roughly 1.1 percentage points.

Mr. Rassman at Toll Brothers argued that the housing market’s chill is a question of confidence, “led by the consumer being afraid” that prices might fall. But he argued that still-low interest rates combined with continued employment growth should eventually feed through into growing demand for homes.

Economists, however, point out that it will take some time for builders to clear out their bloated inventory of unsold houses — a requisite for them to break their fall. With home prices still high by historical standards compared with potential buyers’ incomes, this may be a protracted process, requiring more income gains or price declines.

Richard DeKaser, chief economist at the National City Corporation, predicted that it would take about 9 to 12 months for the supply and demand of homes to come back into balance. “We are probably two-thirds of the way down the slope,” Mr. DeKaser said. “The bulk of the decline is behind us, but we are not yet out of the woods.”

Wednesday, September 13, 2006

Housing decline to bottom out in mid-2007, says industry group

Marketwatch - September 13, 2006 7:16 PM ET

WASHINGTON (MarketWatch) -- A downswing in home sales and building should bottom out sometime during the middle of 2007 before recovering in the latter part of 2008, a home-building industry economist said Wednesday.

In the meantime, said another economist, consumers shouldn't expect a "widespread" bust in home prices as some of the strength begins to dwindle from regional housing markets.

The National Association of Home Builders' David Seiders and the Federal Deposit Insurance Corporation's Richard Brown were among four economists testifying Wednesday before two Senate Banking subcommittees' hearing about the housing bubble and its implications for the U.S. economy.

All four -- including analysts from the National Association of Realtors and the Office of Federal Housing Enterprise Oversight -- agreed housing activity is slowing. Economists added the slowdown poses some risks to the U.S. economy but that a drop-off in activity isn't nationwide.

Seiders said a "below-trend" performance for home sales and building is likely over the next two years.

"The downswing in home sales and housing production should bottom out around the middle of next year before transitioning to a gradual recovery that will raise housing market activity back up toward sustainable trend by the latter part of 2008," Seiders told the subcommittees in prepared testimony.

Brown, meanwhile, told senators that historically, widespread price busts haven't necessarily followed price booms.

But, he cautioned, today there are more boom markets than in the past, and more consumers who have borrowed using "nontraditional" mortgage products, like interest-only loans.

"Borrowers who took on nontraditional loans as a means to afford a more expensive home may be particularly vulnerable to adverse housing market conditions," Brown told the subcommittee in written testimony.

Mortgage applications up

Meanwhile, as the economists were acknowledging a slowdown in housing, another industry group was reporting that mortgage applications were up in the last week.

The number of applications for mortgages filed with major U.S. banks rose a seasonally adjusted 3.2% last week, the Mortgage Bankers Association reported Wednesday. See full story.

However, application volumes are still down 22.8% compared with the same week a year ago, in line with other data showing the nation's housing market cooling significantly. But applications have rebounded in recent weeks.

Applications for mortgages to purchase homes rose 5.3% on a week-to-week, seasonally adjusted basis, while applications for refinance loans increased 0.1%, the MBA's data showed.

The economic impact of the housing slowdown will vary by region, economists noted. Tom Stevens, the Realtors' president, said solid job growth in Florida, California, Arizona and other states should keep price declines short-lived "as new job holders provide demand and support for the housing market."

Overall, the impact of a slowing housing market on the nation's economy may be comparatively muted, said Seiders.

"The downswing in home sales and housing production will continue to detract from overall economic growth through mid-2007," Seiders testified.

"However," he said, "much of this negative impact should be offset by strengthening activity in other sectors of the U.S. economy, keeping GDP growth reasonably close to a sustainable trend-like performance."

Home price growth slows

Home prices grew at their slowest pace in six and a half years during the second quarter of the year, recently released government figures show.

Last week, the Office of Federal Housing Enterprise Oversight reported that home prices increased at a 4.7% annual rate during the second quarter. Prices had risen at an 8.8% annual rate in the first quarter and peaked at a 17.8% annual pace in the third quarter of 2004. See full story.

Ofheo director James Lockhart said the data are "a strong indication that the housing market is cooling in a very significant way."

Earlier Wednesday, Lockhart once again pressed Congress to pass reforms on Fannie Mae (FNM) and Freddie Mac (FRE), the two giant government-sponsored housing enterprises that are major sources of money for U.S. homebuyers. See full story.

Lawmakers have been working to fashion new rules following accounting scandals at both companies. Among the reforms being sought are a new regulator that would have authority to approve the issuing of new products by Fannie and Freddie, and a limit on the amount of mortgage-backed securities each company may hold. Some lawmakers and the Bush administration are concerned that the $1.4 trillion in securities held by the companies is too large and poses a risk to the U.S. financial system.

Congress's reform effort has been stymied and faces uncertainty as lawmakers prepare for elections in November.

Echoing Lockhart, Ofheo's chief economist told senators Wednesday that healthy housing markets could "soften seriously" from unexpected disruptions at Fannie and Freddie. "While both companies have made progress [on reform], much more needs to be done," said economist Patrick Lawler.

WASHINGTON (MarketWatch) -- A downswing in home sales and building should bottom out sometime during the middle of 2007 before recovering in the latter part of 2008, a home-building industry economist said Wednesday.

In the meantime, said another economist, consumers shouldn't expect a "widespread" bust in home prices as some of the strength begins to dwindle from regional housing markets.

The National Association of Home Builders' David Seiders and the Federal Deposit Insurance Corporation's Richard Brown were among four economists testifying Wednesday before two Senate Banking subcommittees' hearing about the housing bubble and its implications for the U.S. economy.

All four -- including analysts from the National Association of Realtors and the Office of Federal Housing Enterprise Oversight -- agreed housing activity is slowing. Economists added the slowdown poses some risks to the U.S. economy but that a drop-off in activity isn't nationwide.

Seiders said a "below-trend" performance for home sales and building is likely over the next two years.

"The downswing in home sales and housing production should bottom out around the middle of next year before transitioning to a gradual recovery that will raise housing market activity back up toward sustainable trend by the latter part of 2008," Seiders told the subcommittees in prepared testimony.

Brown, meanwhile, told senators that historically, widespread price busts haven't necessarily followed price booms.

But, he cautioned, today there are more boom markets than in the past, and more consumers who have borrowed using "nontraditional" mortgage products, like interest-only loans.

"Borrowers who took on nontraditional loans as a means to afford a more expensive home may be particularly vulnerable to adverse housing market conditions," Brown told the subcommittee in written testimony.

Mortgage applications up

Meanwhile, as the economists were acknowledging a slowdown in housing, another industry group was reporting that mortgage applications were up in the last week.

The number of applications for mortgages filed with major U.S. banks rose a seasonally adjusted 3.2% last week, the Mortgage Bankers Association reported Wednesday. See full story.

However, application volumes are still down 22.8% compared with the same week a year ago, in line with other data showing the nation's housing market cooling significantly. But applications have rebounded in recent weeks.

Applications for mortgages to purchase homes rose 5.3% on a week-to-week, seasonally adjusted basis, while applications for refinance loans increased 0.1%, the MBA's data showed.

The economic impact of the housing slowdown will vary by region, economists noted. Tom Stevens, the Realtors' president, said solid job growth in Florida, California, Arizona and other states should keep price declines short-lived "as new job holders provide demand and support for the housing market."

Overall, the impact of a slowing housing market on the nation's economy may be comparatively muted, said Seiders.

"The downswing in home sales and housing production will continue to detract from overall economic growth through mid-2007," Seiders testified.

"However," he said, "much of this negative impact should be offset by strengthening activity in other sectors of the U.S. economy, keeping GDP growth reasonably close to a sustainable trend-like performance."

Home price growth slows

Home prices grew at their slowest pace in six and a half years during the second quarter of the year, recently released government figures show.

Last week, the Office of Federal Housing Enterprise Oversight reported that home prices increased at a 4.7% annual rate during the second quarter. Prices had risen at an 8.8% annual rate in the first quarter and peaked at a 17.8% annual pace in the third quarter of 2004. See full story.

Ofheo director James Lockhart said the data are "a strong indication that the housing market is cooling in a very significant way."

Earlier Wednesday, Lockhart once again pressed Congress to pass reforms on Fannie Mae (FNM) and Freddie Mac (FRE), the two giant government-sponsored housing enterprises that are major sources of money for U.S. homebuyers. See full story.

Lawmakers have been working to fashion new rules following accounting scandals at both companies. Among the reforms being sought are a new regulator that would have authority to approve the issuing of new products by Fannie and Freddie, and a limit on the amount of mortgage-backed securities each company may hold. Some lawmakers and the Bush administration are concerned that the $1.4 trillion in securities held by the companies is too large and poses a risk to the U.S. financial system.

Congress's reform effort has been stymied and faces uncertainty as lawmakers prepare for elections in November.

Echoing Lockhart, Ofheo's chief economist told senators Wednesday that healthy housing markets could "soften seriously" from unexpected disruptions at Fannie and Freddie. "While both companies have made progress [on reform], much more needs to be done," said economist Patrick Lawler.

Wednesday, September 06, 2006

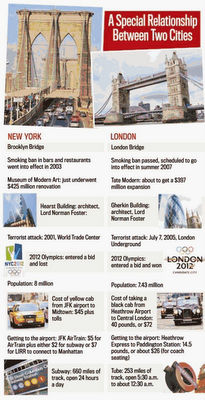

Tale of Two Cities

Have your say in the NY Sun's interactive State/Local Forum.

Is London the New New York? Or Is It the Other Way Around?

New York & London: Tale of Two Cities

By JILL GARDINER - Staff Reporter of the Sun

September 5, 2006

It's a city of nearly 8 million where Mayor Bloomberg owns a townhouse. Paul McCartney, Gwyneth Paltrow, and Madonna all own homes here, too. It competed to host the 2012 Olympic Games. Architects Daniel Libeskind, Norman Foster, and Richard Rogers are all working here or have recently completed buildings. Rupert Murdoch owns a big, conservative, tabloid newspaper here. The art scene is sizzling, real estate is super-pricey, and sushi-lovers can choose from at least two Nobu restaurants. The business world revolves around a big stock market and lots of new hedge funds.

The list of parallels between New York and London has always been long, but lately, with booming economies in both cities and trendy restaurants moving into old industrial neighborhoods, the two are looking more like mirror images.

Some say the two have more in common than any other international cities on the planet, making them both allies and, increasingly, competitors in the global economy.

In the past few years, both have been terrorist targets, competed for the 2012 Olympics (London won), and passed smoking bans for bars, pubs, and restaurants. London's ban, which is modeled after New York's, is scheduled to go into effect next year.

Academics, financial analysts, restaurateurs, art gallery owners, architects, and people who've lived in both cities say while London is still blatantly British in personality, its finance, restaurant, and art industries look more like New York's now than they did five to 10 years ago.

Tuesday, September 05, 2006

August 2006

A stretch of Fifth shakes off inferiority complex

Dub it whatever you want, but blocks of Fifth Avenue in 20s and 30s drawing higher-end retail as condos rise

By John Celock

Richard Cantor, principal of Cantor Pecorella, in front of 325 Fifth Avenue.

Maybe they should call it HiFi.

With a rise in condominium conversions and new residential construction, the section of Fifth Avenue north of Madison Square Park is in the middle of a changeover in its retail stock.

The area, which has long been considered a "no man's land" of vacant storefronts, Class B office space and wholesale retailers catering to decorators, has been a stepsister of the more famous posh Fifth Avenue shopping district 20 blocks north. In the past, retail spaces in the neighborhood have rented for as little as $20 a square foot.

Fifth Avenue between 23rd and 30th streets is now lined primarily with small showrooms for rugs, furniture, decorating supplies and art. The average for retail space in the area now is between $100 and $150 a square foot.

Yet with the arrival of new residential projects including Elad Properties' conversion of the 12-story Gift Building at 225 Fifth Avenue at 26th Street; the Chetrit Group's pending conversion of the 1.2-million-square-foot International Toy Center at 200 Fifth Avenue at 23rd Street; and the Clarett Group's 54-story Sky House rising at 11 East 29th Street, the neighborhood is beginning to see a transition in its retail spaces.

Concurrently, gentrifiers are attempting to find a name for the new neighborhood that will stick. The area, which is sandwiched among several successful real estate boomlets, has been alternately called NoFi (for "North of Flatiron") and SoFi (for "Southern Fifth").

"It has been a deep discount area and a deep manufacturing area," says Faith Hope Consolo, chairwoman of the retail leasing and sales division at Prudential Douglas Elliman. "It has struggled for an identity."

Currently, several retail vacancies dot the landscape between 25th and 27th streets: there are slots at 212 Fifth, 220 Fifth and 226 Fifth.

Consolo, who is handling leasing for 226 Fifth Avenue, says she expects the 1,000-square-foot space to be leased out within the next quarter. The space is currently asking $100 a square foot.

According to Patrick Breslin, president of the retail group at GVA Williams, retail on this portion of Fifth Avenue has long suffered in the shadows at the end of the tourist district at the Empire State Building, along with the shopping pathway leading toward Macy's and Herald Square to the west. The shops of the Flatiron District to the south have been a draw, with customers rarely venturing north.

Chase Welles, senior vice president with Northwest Atlantic Partners, says the changeover is centered now in development of service businesses for the new residents. Banks have been the first arrivals with restaurants beginning to arrive not that far behind.

The banks, including Chase Manhattan (which is leasing 6,000 square feet at the corner of Fifth and 27th), have been locked in bidding wars for the space, paying upward of $250 a square foot in some locations.

Welles sees the new retail spaces being not-too-upscale for the neighborhood, with the area becoming mainly a shopping district for residents, rather than a destination shopping district like Flatiron.

The new residential units are anchored on the northern stretch of the neighborhood by 325 Fifth Avenue, a 50-story condominium building built by Douglaston Development at 32nd Street.

Richard Cantor, principal of Cantor Pecorella, is handling the marketing of the building's residential units and three street-level retail spaces. Cantor's retail marketing strategy has been aimed at bringing in high-end stores for the new residents.

"That neighborhood is a hot area for your traditional Downtown purchaser," Cantor says, noting that the area is becoming an extension of Chelsea and Flatiron. "These are bankers and artists who want a hipper market."

Still, the complete demographic segment of the new residential population has not been completely determined; no definite breakdown can be given between singles and families. Cantor noted that at 325 Fifth, he has seen a wide mix of singles, families and childless couples purchasing units.

Two of the three retail spaces in 325 Fifth have been rented out to a gourmet deli and a hair salon, each paying $150 a square foot. The retail chain 7-Eleven, which offered 25 percent over the asking price to move into the third space, was turned down for not fitting the image the building's owners were looking for.

Cantor sees the third space going to a high-end retailer, most likely a service-related business.

Meanwhile, the decorating wholesalers who have long dominated this stretch of Fifth are beginning to relocate as they are priced out. Welles says many of them have begun to move east toward Madison Avenue and the various side streets, which have retail spaces renting out at prices more conducive to the wholesale decorating budget.

Industry watchers expect more street life in the future. "That part of Fifth at night was quiet," says GVA Williams' Breslin. "But now, with the new development and conversions around Madison Square Park, it will bring people into the neighborhood at night."

Joshua Strauss, managing director for Robert K. Futterman & Associates, agrees. "That was an in-between market with a little bit of office, a little bit of residential and a little bit of hotel," he says. Now, "it's a very hot area, despite what the street looks like."

impossible today to get a property of that scale in an urban location

Curbed Cheatsheet: Stuyvesant Town/Cooper Village Sale

Tuesday, September 5, 2006, by Lockhart

As was first rumored on Curbed back in July, MetLife officially put the 11,200 apartments that comprise Stuyvesant Town and Peter Cooper Village on the block last week. Presumed asking price: $4 billion to $5 billion. How'd the news imact around town? Let's see...

1) Awe. "No doubt in my mind. It’s truly an unprecedented offering and an irreplaceable property. It would be impossible today to get a property of that scale in an urban location. And that neighborhood has become so desirable." [NYTimes]

2) Disbelief. "Stuy Town's two-bedroom apartments have only a single bathroom. The walls of my place were so paper-thin, I got to know everything about my neighbors' family feuds and sex lives... An executive of one company among the prospective bidders said that 'in a normal market,' those weaknesses could seriously lower the price - 'but we're not in a normal market.'" [NYPost]

3) Wistfullness. "It does evoke sadness that more middle income people are going to be forced out of Manhattan. Another step toward Manhattan becoming an exclusive island for the wealthy. How long before Central Park is converted into a golf course?" [True Gotham]

4) Rebellion. "Stuyvesant Town is a middle-class community, and we do not want to lose that identity to the highest bidder." [NYTimes]

That last quote encapsulates today's news on the deal—that a group of residents, backed by the City Council speaker, will try to buy the two complexes to keep them affordable to the middle class. How to fund it? The AFL-CIO's housing investment trust could be used, at least to cover part of the price. Other ideas?

· Official Sees Way to Buy Two Developments [NYTimes]

· Coalition forms, hopes to keep apartment complex affordable [AP via IHT]

Tuesday, September 5, 2006, by Lockhart

As was first rumored on Curbed back in July, MetLife officially put the 11,200 apartments that comprise Stuyvesant Town and Peter Cooper Village on the block last week. Presumed asking price: $4 billion to $5 billion. How'd the news imact around town? Let's see...

1) Awe. "No doubt in my mind. It’s truly an unprecedented offering and an irreplaceable property. It would be impossible today to get a property of that scale in an urban location. And that neighborhood has become so desirable." [NYTimes]

2) Disbelief. "Stuy Town's two-bedroom apartments have only a single bathroom. The walls of my place were so paper-thin, I got to know everything about my neighbors' family feuds and sex lives... An executive of one company among the prospective bidders said that 'in a normal market,' those weaknesses could seriously lower the price - 'but we're not in a normal market.'" [NYPost]

3) Wistfullness. "It does evoke sadness that more middle income people are going to be forced out of Manhattan. Another step toward Manhattan becoming an exclusive island for the wealthy. How long before Central Park is converted into a golf course?" [True Gotham]

4) Rebellion. "Stuyvesant Town is a middle-class community, and we do not want to lose that identity to the highest bidder." [NYTimes]

That last quote encapsulates today's news on the deal—that a group of residents, backed by the City Council speaker, will try to buy the two complexes to keep them affordable to the middle class. How to fund it? The AFL-CIO's housing investment trust could be used, at least to cover part of the price. Other ideas?

· Official Sees Way to Buy Two Developments [NYTimes]

· Coalition forms, hopes to keep apartment complex affordable [AP via IHT]

Tuesday, May 23, 2006

Apartment market a bit worse than it looks

May 2006

Some Manhattan price and volume numbers stay high, but can't hide sharp inventory growth

By Tom Acitelli

Source: Miller Samuel Appraisers Manhattan's apartment market is now not moving up nor down, but rather "sideways," according to brokers and appraisers.

While the most recent apartment data shows what appears to be a continuation of the boom times -- with the median price of a Manhattan apartment and the average price per square foot setting records in the first quarter of 2006 -- the effect on the broader market is more ambiguous. Despite strong numbers posted as a result of Wall Street bonus money, the number of listings on the market -- and the time they stay there -- is climbing significantly.

The median sales price hit an all-time record of $825,000 in the first quarter, up 8.6 percent from the fourth quarter of 2005. The average price per square foot was $1,004, up $2 from the quarter before, according to a report from appraisal firm Miller Samuel and brokerage Prudential Douglas Elliman.

The number of sales jumped an impressive 27.4 percent, but the number of listings rose 16 percent over the quarter before and is up sharply from the same time last year -- by more than 60 percent.

"We have an upside on some of the statistics, but some of them are a little misleading," said Jonathan Miller, president of appraisal firm Miller Samuel. "I would characterize the market overall as moving sideways."

Miller said the annual wave of Wall Street bonus money boosted sales volume and gave the appearance of prices heading upward, but that was because those buyers purchased larger apartments.

"Like prior first quarters, this quarter was about the influx of Wall Street bonus money," he said. "You had a gain in market share of larger apartments. It wasn't that they were appreciating. It's that there were more of those types of units sold."

Fifty-one percent of all apartments sold in the first three months of the year in Manhattan were two-bedrooms or larger; that's up from 45 percent in the fourth quarter of 2005. Larger condos, especially, were popular among buyers. Nearly 60 percent of condo deals closed in the first quarter were for units with at least two-bedrooms, about a 12 percentage increase over the larger-condo market share in the fourth quarter.

Still, the most notable statistic Miller pointed out for the quarter was also the most gloomy -- the rise in listings on the market. There were 6,904 apartments available for sale during the first quarter, a huge jump from the same time last year.

"Probably the biggest story of the first quarter has been the surge of listing inventory," he said. "It's something other than mortgage rates we have to look at closely.

"The number of listings available for sale was up 60 percent over the same quarter last year," he added. "However, the 60 percent figure is somewhat exaggerated in that the prior year quarter results were at near record lows."

But there is a silver lining: Apartment prices are still ahead of last year. The average sales price for a Manhattan apartment stood at $1,300,928 at the end of the first quarter, up 9.6 percent from the fourth quarter and still up 7 percent over the first quarter of 2005, according to Miller Samuel.

Meanwhile, the average number of days it takes to sell an apartment increased slightly during the first quarter, going to 138 days compared to 137 the quarter before. That's well above the average of 94 days during the first quarter of 2005.

Prices of both co-ops and condos increased at the start of the year.

The average price of a co-op went up 7.2 percent over the fourth quarter to $1,093,361, according to Miller Samuel. The average price of a Manhattan condo went 7.1 percent higher quarter over quarter to $1,481,219. This figure still represented a dip compared to the first quarter of 2005, however.

And while the beginning of the year was about larger apartment sales as a result of Wall Street bonus money, brokers say the summer market will be about smaller apartments.

"Summer is usually a time for the smaller apartments," said Diane Ramirez, president of brokerage Halstead Property. "It's when people are looking to buy their first apartment or maybe even move up to their second one -- they tend to have a little more time at their workplaces during the summer. So they typically feel they can look more."

In three out of the last five years -- 2001, 2003, and 2004 -- sales closed have increased from the spring to the summer, though this may be more of a reflection of deals that went into contract in the spring, which is usually the strongest time of year in terms of sales.

In both 2003 and 2004, nearly 30 percent of all apartment sales in the borough closed over the summer, according to Miller Samuel. From 2001 through 2005, at least 24 percent of the sales for each year were summer deals.

Ariel Cohen, a broker with the Shvo Group, deals mostly with smaller apartments, two-bedrooms through studios. He said that, like Ramirez from Halstead, smaller apartments are going to dominate Manhattan summer sales. The sales market won't necessarily be any busier than it was in the first months of 2006, Cohen said, but will nonetheless be brisk. "It all depends," he said, "on what the price is."

Some Manhattan price and volume numbers stay high, but can't hide sharp inventory growth

By Tom Acitelli

Source: Miller Samuel Appraisers Manhattan's apartment market is now not moving up nor down, but rather "sideways," according to brokers and appraisers.

While the most recent apartment data shows what appears to be a continuation of the boom times -- with the median price of a Manhattan apartment and the average price per square foot setting records in the first quarter of 2006 -- the effect on the broader market is more ambiguous. Despite strong numbers posted as a result of Wall Street bonus money, the number of listings on the market -- and the time they stay there -- is climbing significantly.

The median sales price hit an all-time record of $825,000 in the first quarter, up 8.6 percent from the fourth quarter of 2005. The average price per square foot was $1,004, up $2 from the quarter before, according to a report from appraisal firm Miller Samuel and brokerage Prudential Douglas Elliman.

The number of sales jumped an impressive 27.4 percent, but the number of listings rose 16 percent over the quarter before and is up sharply from the same time last year -- by more than 60 percent.

"We have an upside on some of the statistics, but some of them are a little misleading," said Jonathan Miller, president of appraisal firm Miller Samuel. "I would characterize the market overall as moving sideways."

Miller said the annual wave of Wall Street bonus money boosted sales volume and gave the appearance of prices heading upward, but that was because those buyers purchased larger apartments.

"Like prior first quarters, this quarter was about the influx of Wall Street bonus money," he said. "You had a gain in market share of larger apartments. It wasn't that they were appreciating. It's that there were more of those types of units sold."

Fifty-one percent of all apartments sold in the first three months of the year in Manhattan were two-bedrooms or larger; that's up from 45 percent in the fourth quarter of 2005. Larger condos, especially, were popular among buyers. Nearly 60 percent of condo deals closed in the first quarter were for units with at least two-bedrooms, about a 12 percentage increase over the larger-condo market share in the fourth quarter.

Still, the most notable statistic Miller pointed out for the quarter was also the most gloomy -- the rise in listings on the market. There were 6,904 apartments available for sale during the first quarter, a huge jump from the same time last year.

"Probably the biggest story of the first quarter has been the surge of listing inventory," he said. "It's something other than mortgage rates we have to look at closely.

"The number of listings available for sale was up 60 percent over the same quarter last year," he added. "However, the 60 percent figure is somewhat exaggerated in that the prior year quarter results were at near record lows."

But there is a silver lining: Apartment prices are still ahead of last year. The average sales price for a Manhattan apartment stood at $1,300,928 at the end of the first quarter, up 9.6 percent from the fourth quarter and still up 7 percent over the first quarter of 2005, according to Miller Samuel.

Meanwhile, the average number of days it takes to sell an apartment increased slightly during the first quarter, going to 138 days compared to 137 the quarter before. That's well above the average of 94 days during the first quarter of 2005.

Prices of both co-ops and condos increased at the start of the year.

The average price of a co-op went up 7.2 percent over the fourth quarter to $1,093,361, according to Miller Samuel. The average price of a Manhattan condo went 7.1 percent higher quarter over quarter to $1,481,219. This figure still represented a dip compared to the first quarter of 2005, however.

And while the beginning of the year was about larger apartment sales as a result of Wall Street bonus money, brokers say the summer market will be about smaller apartments.

"Summer is usually a time for the smaller apartments," said Diane Ramirez, president of brokerage Halstead Property. "It's when people are looking to buy their first apartment or maybe even move up to their second one -- they tend to have a little more time at their workplaces during the summer. So they typically feel they can look more."

In three out of the last five years -- 2001, 2003, and 2004 -- sales closed have increased from the spring to the summer, though this may be more of a reflection of deals that went into contract in the spring, which is usually the strongest time of year in terms of sales.

In both 2003 and 2004, nearly 30 percent of all apartment sales in the borough closed over the summer, according to Miller Samuel. From 2001 through 2005, at least 24 percent of the sales for each year were summer deals.

Ariel Cohen, a broker with the Shvo Group, deals mostly with smaller apartments, two-bedrooms through studios. He said that, like Ramirez from Halstead, smaller apartments are going to dominate Manhattan summer sales. The sales market won't necessarily be any busier than it was in the first months of 2006, Cohen said, but will nonetheless be brisk. "It all depends," he said, "on what the price is."

Subscribe to:

Posts (Atom)