FORGET SHINY AND NEW; THESE CLASSIC RESIDENCES STILL SET THE STANDARD

By KATHERINE DYKSTRA

SHERRY BABY: Resales of the Sherry-Netherland's residences tend to happen by word of mouth.

September 6, 2007 -- Apartment buyers who want a taste of the suite life now have more options than ever.

"If you look at the trends in hotels and hotel development, most being built will offer some form of ownership - whole or fractional or condo hotels," says David Matheson, vice president of corporate communications at Midtown's St. Regis Hotel, which has two floors of full-ownership condos.

Take Trump SoHo, the Financial District's W Downtown and TriBeCa's Smyth Upstairs. All are hotels. All offer some variation on ownership. All tout "hotel amenities" - housekeeping, room service, concierge.

Even under-construction condo-only projects have co-opted hotel-like perks, including free continental breakfast, newspapers and business centers, as major selling points.

But with all the buzz surrounding spanking-new buildings, it's easy to forget (even with the Plaza steadily unloading $25 million units) that hotel living doesn't only come in tall and glassy. In fact, the city's obsession with the five-star life was born from classic hotel living.

Many of the mainstays offer homes you can move into immediately; others are being converted into some of New York's most coveted residential buildings.

The Mark, originally opened in 1927 and now being renovated into 118 hotel rooms and 42 co-op residences - including a 9,799-square-foot penthouse with an estimated price of around $60 million - is not only the latest classic hotel-cum-residence. It's also poised to elevate the standard of service for residential conversions as a whole. When it's finished in 2008, the East 77th Street building's inhabitants will have access to valet parking, laundry and dry-cleaning valet, fresh flower service, and personal shopping among other don't-lift-a-finger amenities. Which might just give the St. Regis and the Plaza a run for their money.

"In all my years in this business, I have never seen this much interest. There are 18 letters of intent on the penthouse alone," says Louise Sunshine, development director of the Alexico Group, the firm responsible for the Mark. "All of the other suites have no less than 25 letters of intent for each."

Suites will open at $5,000 a square foot, but Sunshine says, "There will probably be bidding wars for each suite, and it wouldn't surprise me if we ended up at $6,000 at the very least, on average."

If you don't want to wait for the Mark, and the Time Warner Center's Mandarin Oriental is just too 21st Century, there are plenty of hotels oozing old-world glamour that you can buy a residence in today. There are co-ops like the Pierre, the Carlyle: A Rosewood Hotel, the Lombardy and the Sherry-Netherland; condo conversions like the St. Regis and the Jumeirah Essex House; and even rentals at the Waldorf-Astoria.

NEVER CHECK OUT

Hotel living is nothing new. Before the St. Regis, the Carlyle and the Sherry-Netherland added actual salable residences, Salvador Dali, Jackie Kennedy and Ronald Reagan had extended-stay leases in each, respectively. ("I Love You, Ronnie," a compilation of Reagan's correspondence with his wife Nancy includes a letter on Sherry-Netherland stationery.)

But it wasn't until the mid-'50s, when the city saw an economic slowdown, that a number of hotels - notably the Pierre, the Lombardy, the Carlyle and the Sherry-Netherland - figured out that they could survive the downturn by converting to co-op. Each co-op then turned around and leased keys to hotels.

"There were some residential aspects; there were some people living there on long-term rentals," says Richard Siegler, an attorney for a number of co-ops, including the Pierre. "The owners decided to cash in."

The allure of hotel living is obvious: maid service, room service, concierge, bellman, all at your beck and call.

"If you want your bed covers straightened because you don't like the way they look during the day, you call housekeeping ... or if a light bulb goes out," says Michael Littler, executive vice president and chief operating officer of the Sherry-Netherland. "If you're hungry, call room service. If you need something from the drugstore, call the concierge."

The high cost of hotel living allowed only the very wealthiest of people to buy units and made owning a home in one of these buildings a symbol of wealth and power. "Fifty or 60 years ago the [Sherry-Netherland] was very much a haven for people in the arts, movies," says Littler. "For instance, the producer Sam Goldwyn had an apartment here; Sofia Coppola grew up here."

These buildings' sterling reputations remain today.

"There is an exclusivity to the co-op hotels," says Hall Wilkie, president of Brown Harris Stevens. "These old prewar buildings are the most desirable in New York. It's prestige more than anything else, based on architectural history and location."

The Pierre, on Fifth Avenue and 61st Street, was built in 1930 by renowned Jazz Age architects Leonard Schultze and S. Fullerton Weaver. As was the Sherry-Netherland and the Waldorf Towers, the rental portion of the Waldorf-Astoria. The St. Regis, off Fifth Avenue at 55th Street, was developed by John Jacob Astor more than a century ago. The interiors of the Carlyle, on Madison Avenue and 76th Street, were done in 1930 by renowned designer Dorothy Draper.

Mostly, the hotels were designed to favor privacy over flash and flair, making them ideal for daily living.

"Even though it has a hotel element, it feels like private residences," says Littler. "The lobby is small; you reduce the size and it feels more intimate."

And though most hotels hold tight to their original aesthetic, many regularly update their services. The Jumeirah Essex House, which was originally constructed in 1931 (at the time it was Manhattan's tallest building at 40 stories) and which added its first condos in 1974, is renovating its lobby, restaurant and spa in conjunction with converting 90 hotel rooms into 32 condos, 60 percent of which have already sold. The Carlyle is adding a Sense spa. And the Waldorf-Astoria will open the country's first Guerlain Spa in November.

Currently on the market are units at the St. Regis, which average $5,200 a square foot, resales of Sherry-Netherland, Carlyle and Pierre residences, including the Pierre's notorious $70 million penthouse, which was a ballroom until the building was converted to co-op in 1959. Residents voted to shutter it because all the black-tie dinners and weddings were tying up the elevators. It remained vacant until the early '90s when Lady Fairfax from Australia bought the ballroom and the service room below it. She converted the spaces into an 11,000-square-foot triplex, which has been on the market for more than two years.

What does it mean to reside in one of these hotels today?

The hotels "provide worry-free living," says Wilkie. "If you're traveling or have other homes, those services can mean even more when you come in and everything is set. Food is there if you arrive at 3 in the morning."

Or more simply: "It means you're very, very comfortable," says Littler.

Your New York Broker

Thursday, September 06, 2007

Condos, Brand-New Yet Not So Perfect

By CHRISTINE HAUGHNEY

Published: August 26, 2007

WHEN dozens of buyers put down payments on apartments in the glassy new condominium tower called the Link at 310 West 52nd Street, they were looking forward to living with features like floor-to-ceiling windows and a meditation garden. But six months after they started moving in, they are still living in a construction site with an unfinished lobby, uncarpeted hallways and no access to the garden that was supposed to help them escape from the city’s stresses.

If a Window Is Cracked, or a Toilet Leaks (August 26, 2007)

Carl G. Chernoff in the lobby at the Link in Manhattan on Aug. 8. After he and his wife moved in last February, they had no hot water for baths or showers.

The Link is one of many new condos in New York City whose owners complain that developers have been slow to deliver what they promised. “People are spending a lot of money and have high expectations,” said Robert Braverman, a real estate lawyer hired by buyers at the Link.

Anger toward developers is coming to a head as a record number of units are nearing completion. Manhattan will have 6,444 new condominiums completed this year, compared with 1,614 in 2005, according to Halstead Development Marketing. In Brooklyn, 3,768 units should be finished this year, compared with 480 in 2005.

About 40 owners at the Link became so frustrated with the developer, El Ad Properties, which is also renovating the Plaza Hotel, that they hired Mr. Braverman in an effort to get an executive at El Ad to meet with them.

Lloyd Kaplan, the company’s spokesman, said that El Ad’s head of construction would meet with owners as long as they didn’t bring their lawyer.

Mr. Kaplan said that the company had tried to address all of the individual owners’ problems and that the builder expected to complete everything by Nov. 15, nine months after the first residents’ arrival.

Mr. Braverman says he was hired because El Ad didn’t meet buyers’ expectations of moving into a finished or nearly finished apartment building. He said a block of unit owners were also hiring an engineer to make sure that buildingwide systems like heating, cooling and plumbing met the quality standards promised in the offering plan and were installed as the plan had indicated they would be.

But Mr. Braverman has told buyers that their recourse is limited. Developers have to deliver only what they outline in the offering plan — the book that buyers receive after putting down a deposit, allowing them to review all of a building’s fixtures and features. He said that beyond this, developers are not obliged to deliver on any promise. “The sponsor can say, ‘We’re building the Taj Mahal.’ ”

This means that buyers who are preparing to move into these condos are finding they have little power to get their units finished when they expect them or in the shape they anticipated.

Carl G. Chernoff, who in February moved into a $1.2 million two-bedroom apartment in the Link, said that for the first month, he and his wife, Rosalind, were unable to take a hot shower or bath. “You shouldn’t have to go through these agonies,” he said.

When the Chernoffs moved in, they called and wrote e-mail messages about several problems, from a chipped shower tile to an ill-fitting bathtub stopper. But they were most upset about not being able to bathe in hot water (they had hot water in one sink). Ms. Chernoff has cancer and did not want to have to shower at the nearby Gold’s Gym where they had memberships.

“Every new building has problems,” Mr. Chernoff said. “She was ill, and they knew it. They knew that all she wanted to do was to come home from chemotherapy and take a warm bath.”

Tim Wright, a 28-year-old stockbroker at Olympia Asset Management, said he was so frustrated with the continued construction at the Link that he sold his one-bedroom apartment for $975,000 four months after he moved in. (He had bought the apartment more than a year earlier for $795,000.)

Mr. Wright said he complained repeatedly to management about construction workers who smoked near his apartment and was frustrated that the building hadn’t installed a vanity mirror in the master bathroom for his girlfriend to use.

“I’m not really the kind of person who complained a lot,” he said. “I was sick and tired of walking in and out of a construction site.”

For some condo buyers, the main difficulty is finding out when they can move into their buildings. Cory FitzGerald, a 25-year-old lighting programmer for productions like the Christmas show at Radio City, thought he would be able to move into his two-bedroom apartment at 606 West 148th Street in Hamilton Heights late last year.

In anticipation, he moved out of his rental last November, had his mail sent to his parents’ address in California, and went off to work on concert tours around the country and in Japan, South Korea and Hong Kong. During that time, he lived out of two suitcases and kept his belongings in storage. But the completion date kept being delayed. He said that the most frustrating part was not knowing what caused the delays. He searched the city’s Buildings Department Web site for clues.

He considered walking away from the deal because he had included a “drop dead” clause in his contract that allowed him to pull out by March 31 if the developers hadn’t received the temporary certificate of occupancy. But by then, he said, he couldn’t find a similar two-bedroom for the $596,000 he had paid. He was finally able to move in in July, about eight months later than he had expected.

“Until I moved in, there was no end in sight,” he said. “It was like a shot in the dark, and nobody had any information to share.”

Greg Baron, one of the project’s developers, said he did not feel comfortable explaining reasons for delays to buyers who did not have construction backgrounds and therefore would not understand the project’s complexity. But he later told a reporter that the project involved constructing two buildings on one of the steepest hills in Manhattan.

Linda Rubin, the Prudential Douglas Elliman broker handling sales for the building, who is also Mr. Baron’s wife, said she did not want buyers to worry about construction.

Still, she said that developers may have to provide more information in the future — for example, setting up a Web site to explain what is delaying the project. “It’s just not the standard procedure for the developer to give updates,” she said. “But times are changing.”

Some buyers have had to become relentless nags to get problems fixed after moving in. Ethan Henerey and Kate Eales, who moved into a $645,000 three-bedroom condominium in Kensington, Brooklyn, on July 15, have been able to get a lot of problems in their apartment repaired, but still have more that have not been addressed. They had water damage in one bathroom and a leaky skylight, and they still have standing water on their roof deck.

Since they moved in, Ms. Eales and Mr. Henerey, both film editors, worked in shifts to get problems fixed. She devoted a week of vacation to repairs, and Mr. Henerey, who works at night and is at home during the day, can give workers access to the apartment.

“I feel a little bit trapped because many days I’m sitting here waiting to find out if the roofer is going to show up or if the contractors are going to come in,” Mr. Henerey said.

Eddie Hidary, an owner of Gracie Developers, which built the condos, said repairs were delayed because he had trouble getting his contractors to respond as quickly as necessary to all of the units that were closing at the same time.

Mr. Hidary said it took several weeks to figure out the source of the leak, but a new roof has now been installed. He said that his company was eager to fix these problems, especially because this is its first residential project.

Mr. Henerey and Ms. Eales confirmed that the roof no longer leaks and said that Mr. Hidary had been responsive to their complaints. He is still trying to replace a wall damaged by the skylight leak, and the couple have a list of smaller problems that Mr. Hidary has said he would fix, like installing smoke detectors and repairing the air-conditioning in the master bedroom.

“We’re trying to establish a name in the industry,” Mr. Hidary said. “If it costs a few dollars, it costs a few dollars.”

Some buyers, frustrated when they cannot get questions answered, pull out of deals before they move in. Tannaz Simyar, a 29-year-old real estate lawyer, was interested in buying a one-bedroom apartment at 184 Thompson Street, a new condo conversion. But she had read negative blog postings about the building that worried her.

Ms. Simyar had a number of questions that she said the building’s sales representative could not answer when she visited the sales office with her agent, Ben Morales of Barak Realty.

As she described the chain of events, she visited the office several times over about 10 days trying to get answers. After her third visit, she put down a $250 deposit on a $750,000 apartment. But Ms. Simyar said she would not make the $75,000 down payment until the sales representative confirmed that the ceiling height in a section of loft space was six feet, that it could be used as a bedroom and that it would have hardwood floors.

Ms. Simyar said she even had her broker call in advance of that third visit to arrange for a ladder so she could measure the loft herself. But when she arrived, the sales office provided a ladder that was too short.

Several days after her third visit, she heard from the sales representative that the ceiling in the loft space was only five feet high and that the floor would be carpeted. So she asked for her $250 deposit back. She got it only after threatening to complain to the attorney general’s office, she said.

“My gut instinct was that something wasn’t right,” Ms. Simyar said.

Sarah Burke, the vice president for sales and marketing at the Developers Group, which represents 184 Thompson, said that staff members had tried to respond to Ms. Simyar’s questions and to quickly return her deposit.

Hy Chalme, the building’s developer, said in a statement, “We’ve sold 90 percent of the homes in record time to buyers who were extremely happy with the service of our sales team and the quality of the units.”

But not Ms. Simyar. She later put down a deposit for an $860,000 one-bedroom at the District at 151 William Street, where she said the sales agent, Nikki Martin, was quite responsive.

“She answers all of your questions before you even ask them,” she said.

Published: August 26, 2007

WHEN dozens of buyers put down payments on apartments in the glassy new condominium tower called the Link at 310 West 52nd Street, they were looking forward to living with features like floor-to-ceiling windows and a meditation garden. But six months after they started moving in, they are still living in a construction site with an unfinished lobby, uncarpeted hallways and no access to the garden that was supposed to help them escape from the city’s stresses.

If a Window Is Cracked, or a Toilet Leaks (August 26, 2007)

Carl G. Chernoff in the lobby at the Link in Manhattan on Aug. 8. After he and his wife moved in last February, they had no hot water for baths or showers.

The Link is one of many new condos in New York City whose owners complain that developers have been slow to deliver what they promised. “People are spending a lot of money and have high expectations,” said Robert Braverman, a real estate lawyer hired by buyers at the Link.

Anger toward developers is coming to a head as a record number of units are nearing completion. Manhattan will have 6,444 new condominiums completed this year, compared with 1,614 in 2005, according to Halstead Development Marketing. In Brooklyn, 3,768 units should be finished this year, compared with 480 in 2005.

About 40 owners at the Link became so frustrated with the developer, El Ad Properties, which is also renovating the Plaza Hotel, that they hired Mr. Braverman in an effort to get an executive at El Ad to meet with them.

Lloyd Kaplan, the company’s spokesman, said that El Ad’s head of construction would meet with owners as long as they didn’t bring their lawyer.

Mr. Kaplan said that the company had tried to address all of the individual owners’ problems and that the builder expected to complete everything by Nov. 15, nine months after the first residents’ arrival.

Mr. Braverman says he was hired because El Ad didn’t meet buyers’ expectations of moving into a finished or nearly finished apartment building. He said a block of unit owners were also hiring an engineer to make sure that buildingwide systems like heating, cooling and plumbing met the quality standards promised in the offering plan and were installed as the plan had indicated they would be.

But Mr. Braverman has told buyers that their recourse is limited. Developers have to deliver only what they outline in the offering plan — the book that buyers receive after putting down a deposit, allowing them to review all of a building’s fixtures and features. He said that beyond this, developers are not obliged to deliver on any promise. “The sponsor can say, ‘We’re building the Taj Mahal.’ ”

This means that buyers who are preparing to move into these condos are finding they have little power to get their units finished when they expect them or in the shape they anticipated.

Carl G. Chernoff, who in February moved into a $1.2 million two-bedroom apartment in the Link, said that for the first month, he and his wife, Rosalind, were unable to take a hot shower or bath. “You shouldn’t have to go through these agonies,” he said.

When the Chernoffs moved in, they called and wrote e-mail messages about several problems, from a chipped shower tile to an ill-fitting bathtub stopper. But they were most upset about not being able to bathe in hot water (they had hot water in one sink). Ms. Chernoff has cancer and did not want to have to shower at the nearby Gold’s Gym where they had memberships.

“Every new building has problems,” Mr. Chernoff said. “She was ill, and they knew it. They knew that all she wanted to do was to come home from chemotherapy and take a warm bath.”

Tim Wright, a 28-year-old stockbroker at Olympia Asset Management, said he was so frustrated with the continued construction at the Link that he sold his one-bedroom apartment for $975,000 four months after he moved in. (He had bought the apartment more than a year earlier for $795,000.)

Mr. Wright said he complained repeatedly to management about construction workers who smoked near his apartment and was frustrated that the building hadn’t installed a vanity mirror in the master bathroom for his girlfriend to use.

“I’m not really the kind of person who complained a lot,” he said. “I was sick and tired of walking in and out of a construction site.”

For some condo buyers, the main difficulty is finding out when they can move into their buildings. Cory FitzGerald, a 25-year-old lighting programmer for productions like the Christmas show at Radio City, thought he would be able to move into his two-bedroom apartment at 606 West 148th Street in Hamilton Heights late last year.

In anticipation, he moved out of his rental last November, had his mail sent to his parents’ address in California, and went off to work on concert tours around the country and in Japan, South Korea and Hong Kong. During that time, he lived out of two suitcases and kept his belongings in storage. But the completion date kept being delayed. He said that the most frustrating part was not knowing what caused the delays. He searched the city’s Buildings Department Web site for clues.

He considered walking away from the deal because he had included a “drop dead” clause in his contract that allowed him to pull out by March 31 if the developers hadn’t received the temporary certificate of occupancy. But by then, he said, he couldn’t find a similar two-bedroom for the $596,000 he had paid. He was finally able to move in in July, about eight months later than he had expected.

“Until I moved in, there was no end in sight,” he said. “It was like a shot in the dark, and nobody had any information to share.”

Greg Baron, one of the project’s developers, said he did not feel comfortable explaining reasons for delays to buyers who did not have construction backgrounds and therefore would not understand the project’s complexity. But he later told a reporter that the project involved constructing two buildings on one of the steepest hills in Manhattan.

Linda Rubin, the Prudential Douglas Elliman broker handling sales for the building, who is also Mr. Baron’s wife, said she did not want buyers to worry about construction.

Still, she said that developers may have to provide more information in the future — for example, setting up a Web site to explain what is delaying the project. “It’s just not the standard procedure for the developer to give updates,” she said. “But times are changing.”

Some buyers have had to become relentless nags to get problems fixed after moving in. Ethan Henerey and Kate Eales, who moved into a $645,000 three-bedroom condominium in Kensington, Brooklyn, on July 15, have been able to get a lot of problems in their apartment repaired, but still have more that have not been addressed. They had water damage in one bathroom and a leaky skylight, and they still have standing water on their roof deck.

Since they moved in, Ms. Eales and Mr. Henerey, both film editors, worked in shifts to get problems fixed. She devoted a week of vacation to repairs, and Mr. Henerey, who works at night and is at home during the day, can give workers access to the apartment.

“I feel a little bit trapped because many days I’m sitting here waiting to find out if the roofer is going to show up or if the contractors are going to come in,” Mr. Henerey said.

Eddie Hidary, an owner of Gracie Developers, which built the condos, said repairs were delayed because he had trouble getting his contractors to respond as quickly as necessary to all of the units that were closing at the same time.

Mr. Hidary said it took several weeks to figure out the source of the leak, but a new roof has now been installed. He said that his company was eager to fix these problems, especially because this is its first residential project.

Mr. Henerey and Ms. Eales confirmed that the roof no longer leaks and said that Mr. Hidary had been responsive to their complaints. He is still trying to replace a wall damaged by the skylight leak, and the couple have a list of smaller problems that Mr. Hidary has said he would fix, like installing smoke detectors and repairing the air-conditioning in the master bedroom.

“We’re trying to establish a name in the industry,” Mr. Hidary said. “If it costs a few dollars, it costs a few dollars.”

Some buyers, frustrated when they cannot get questions answered, pull out of deals before they move in. Tannaz Simyar, a 29-year-old real estate lawyer, was interested in buying a one-bedroom apartment at 184 Thompson Street, a new condo conversion. But she had read negative blog postings about the building that worried her.

Ms. Simyar had a number of questions that she said the building’s sales representative could not answer when she visited the sales office with her agent, Ben Morales of Barak Realty.

As she described the chain of events, she visited the office several times over about 10 days trying to get answers. After her third visit, she put down a $250 deposit on a $750,000 apartment. But Ms. Simyar said she would not make the $75,000 down payment until the sales representative confirmed that the ceiling height in a section of loft space was six feet, that it could be used as a bedroom and that it would have hardwood floors.

Ms. Simyar said she even had her broker call in advance of that third visit to arrange for a ladder so she could measure the loft herself. But when she arrived, the sales office provided a ladder that was too short.

Several days after her third visit, she heard from the sales representative that the ceiling in the loft space was only five feet high and that the floor would be carpeted. So she asked for her $250 deposit back. She got it only after threatening to complain to the attorney general’s office, she said.

“My gut instinct was that something wasn’t right,” Ms. Simyar said.

Sarah Burke, the vice president for sales and marketing at the Developers Group, which represents 184 Thompson, said that staff members had tried to respond to Ms. Simyar’s questions and to quickly return her deposit.

Hy Chalme, the building’s developer, said in a statement, “We’ve sold 90 percent of the homes in record time to buyers who were extremely happy with the service of our sales team and the quality of the units.”

But not Ms. Simyar. She later put down a deposit for an $860,000 one-bedroom at the District at 151 William Street, where she said the sales agent, Nikki Martin, was quite responsive.

“She answers all of your questions before you even ask them,” she said.

Wednesday, August 22, 2007

It wasn’t supposed to happen this way.

The Manhattan Real Estate Slump That Wasn’t

By TERI KARUSH ROGERS

Published: August 19, 2007

Just a year ago, as real estate brokers fretted through an ominously quiet third quarter, many Manhattanites waited for the housing market to reverse its madcap ascent and fall into line with the rest of the country.

But something happened on the way to the Great Manhattan Housing Slump. After what brokers optimistically termed a “pause” in the second half of 2006, buyers swarmed into the market. The torrent was so intense that by the end of this past June, it was clear that an astonishing gulf had opened up between Manhattan and nearly everywhere else.

On the national level, sales of existing homes slowed by 17 percent in the second quarter of 2007, compared with the second quarter of 2006, while inventory swelled by 16 percent, according to figures provided by the National Association of Realtors. New homes fared even worse: they fell by almost 19 percent, according to Commerce Department figures.

In Manhattan, by comparison, sales of new and existing apartments more than doubled. In a trend that could shift quickly in light of the recent problems in the credit and stock markets, inventory shed a third of its bulk. It dropped to 5,237 units, despite the influx of several thousand new condos, according to Miller Samuel Inc., the Manhattan appraisal company

Prices have been starkly different as well. By last month, the national picture was so dire that Angelo R. Mozilo, the chairman and chief executive of Countrywide Financial, the country’s largest mortgage lender, said things had not been so bleak since the Depression.

Cut to Manhattan. After a boom with annual price increases of 20 percent or more ended in mid-2005, prices have continued to rise over all, but not as sharply. In the second quarter of 2007, Miller Samuel said the average sale price of a Manhattan studio climbed 16.5 percent compared with the second quarter of 2005. The average for a one-bedroom climbed by 18.4 percent and a two-bedroom by 5.9 percent.

Apartments with three bedrooms, which make up about 6 percent of the market but appeal to an ever-more-moneyed class of buyers, rose by 17.9 percent in the same period.

Major brokerages, including Halstead Property, Bellmarc Realty, Brown Harris Stevens, Prudential Douglas Elliman and the Corcoran Group, say they are recording sales and profits that rival boom-time results. In fact, Douglas Elliman and Corcoran predict that this will be their most lucrative year by far.

Whether this momentum can be sustained remains to be seen, particularly in light of the recent gyrations in the debt market, which have led to a reduction in the availability of large mortgages and to an increase in their rates. A deepening credit-market crisis and national housing slump could squeeze the economy, the stock market and bonus pools.

“For the first time in over a year, there is some negative talk — about the credit markets and whether or not this will permeate the New York City real estate market,” said Pamela Liebman, president of Corcoran. “As of right now, it hasn’t. There has been no slowdown.” She said the biggest concern among her agents is finding enough inventory to satisfy demand.

But a buying binge alone does not a housing boom make. “I’m still not characterizing the market right now as a housing boom except in the upper echelon,” said Jonathan Miller, president of Miller Samuel.

So how has Manhattan (and, to a lesser extent, sought-after pockets of Brooklyn) managed to avoid a slump?

“Obviously, the market was helped first by the rumor and the reality of bonus money,” said Frederick W. Peters, president of Warburg Realty. He was referring to the fourth straight year of substantial bonus increases, particularly on Wall Street, that along with a rising stock market helped push buyers off the sidelines at the end of 2006 and caused some agents to cancel their winter vacations.

“But I also think we’re just in one of those demographic upswing periods,” Mr. Peters added. “More people are moving into the city, fewer people are moving out, and the rental market got much tighter over the course of 2006, which once again made buying a more attractive option. You put all those things together, and the market sort of entered the narrow part of the hourglass.”

There were other factors to consider, too. Tourism is at record highs, and the local economy is doing well in general. And it’s nearly as hard to find premium office space or a spot in private school as it is to find a family-size apartment.

But that’s exactly what more and more families have set their sights on.

It has been years since Samantha Kleier Forbes, a broker at Gumley Haft Kleier, lost a client to the suburbs. “My last casualty was in ’04,” she said. As two-career couples work longer hours and as the city grows safer and more family-friendly, there is a big demand for large apartments like Classic 6’s — a two-bedroom apartment with living room, dining room, kitchen and maid’s room (where children can be found bunking like sailors).

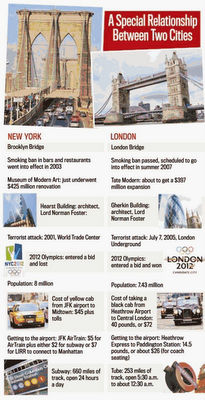

Families who want to stay, brokers say, are only one segment of the more stratified and well-heeled masses clamoring for a piece of Manhattan. While the dollar’s seemingly endless slide may have crimped the foreign vacation plans of many Americans, the purchasing power of Europeans has strengthened. They are increasingly matched, if not outmatched, by buyers from countries like China and India. And foreign buyers find Manhattan real estate very appealing when they compare prices in other large international cities like London.

“I’ve had 20 percent more business from international clients in the past couple of years,” said Sallie Stern, a senior vice president and managing director of Brown Harris Stevens. “They probably account for 30 to 35 percent. It’s a world market now.”

Shaun Osher, the chief executive of CORE Group Marketing, which is handling 11 condominium projects in Manhattan, said the number of foreign apartment-seekers had doubled since the end of 2005. Foreign buyers now constitute 5 to 10 percent of the sales in the buildings marketed by his firms.

“When you look at hotel rates and what it costs to come into Manhattan, it makes sense now to buy a pied-à-terre,” he said.

Besides foreign buyers, brokers say, more parents are snapping up apartments for their children, and some retirees are choosing Manhattan over the likes of Boca Raton.

“The baby boomer generation isn’t ready to give up and live in a swamp,” said Darren Sukenik, an executive vice president of Prudential Douglas Elliman. In fact, they are living the lives their nearby children would like to lead if only they weren’t working so hard, he said.

Meanwhile, renters have emerged as a force in the market, particularly for entry-level apartments. “Rents are rising again, and that pushes people back into the condo and co-op market if they have more than a one- or two-year time frame for living in Manhattan,” said Stephen G. Kliegerman, the executive director of marketing for new developments at Halstead Property.

Fanning the flames have been job and population growth, historically low interest rates and a trove of personal wealth minted by hedge funds, private equity firms and, to a lesser extent, the investment banks that serve them. Add to that the psychological comfort of knowing that Manhattan flourished after the Sept. 11 terrorist attacks, and further, that it appears to have shrugged off a national housing slump.

Even the condo glut that so many real estate executives feared has turned out instead to be a boon of sorts. “If we didn’t have new development coming on at the pace we did, we’d have a chronic shortage across all sectors, and we’d see 20 percent price growth,” said Mr. Miller, the appraiser.

Mr. Peters of Warburg Realty agreed. “You can’t even imagine how awful it would be,” he said. On the other hand, he added, things may feel pretty awful already for buyers who want a prewar apartment, since inventory in this sector continues to evaporate. In the last two years, co-ops, about half of which were built before World War II, have slipped from 63 percent of the market to 47 percent as new condos have been built, Miller Samuel said.

“There are so many new units coming on the market and being sold, but the real heart and soul of the co-op market is really depleted,” said Barbara Fox, the president of the Fox Residential Group, a Manhattan brokerage.

Consequently, brokers say, many prewar apartments in good condition, along with family-size apartments of any vintage, are being snatched up in bidding wars whose aggressiveness outrivals those of two years ago.

“The new rule is that there are no rules, and when you’re lying bleeding on your way to the emergency room, you’re still shouting, ‘Higher offer, higher offer!’ ” said Julie Friedman, a senior associate broker at Bellmarc.

She was among the many brokers who said that “best and final” offers have largely become neither, with buyers and sellers routinely negotiating after another bid has been accepted. “You remind sellers that there is a moral component, but my duty is to get the highest amount, and ‘moral’ and ‘the highest amount’ don’t necessarily overlap,” she said.

Some brokers complained that the demise of the sealed bid, which has been replaced over the last two or three years by e-mail offers to the seller’s agent, has further undermined fair play. “Buyers don’t trust them as much,” said Michele Kleier, president of Gumley Haft Kleier.

Whether Manhattan continues to be the land the slump forgot or is merely sunning itself before a hurricane is something of a guess. A strengthening dollar, a severe terrorist attack or a national economy hobbled by housing market woes could inflict blows of varying strengths.

More immediate is the worry about the availability of credit. “While I don’t think we were propped up to the extent other markets were by subprime and adjustable-rate mortgages, it does make credit hard to get for everyone to some degree,” said Gregory J. Heym, an economist for Brown Harris Stevens and Halstead Property. “Most people are probably expecting mortgages to be tougher to get.”

Mortgage lenders everywhere are going back to pre-boom lending standards, so obtaining a mortgage is harder for buyers with pockmarked credit or sketchy employment. But there is no panic over rising mortgage rates on jumbo loans (those exceeding $417,000), at least not now.

Large lenders like Chase and HSBC that typically sell mortgages after they make them can no longer do so because the credit crisis has dried up the secondary market, said Jeffrey Appel, a senior vice president and the director of new development financing at the Preferred Empire Mortgage Company in New York. Many large institutional lenders have raised their rates as a hedge against uncertainty, but rates at smaller regional savings banks, the so-called portfolio lenders who hang on to their loans, have hardly budged.

Last Monday, Melissa L. Cohn, the president of the Manhattan Mortgage Company, the largest residential mortgage broker in the New York, New Jersey and Connecticut, said her best rate on a 30-year $1 million mortgage was 6 7/8 percent, offered by a portfolio lender. And her worst rate, offered by a lender that sells mortgages on the secondary market, was 8 3/8 percent.

“Despite this incredible hysteria,” Ms. Cohn said, “there’s plenty of money for qualified borrowers.”

The credit-market meltdown could yet cloud Manhattan’s real estate prospects because of stock-market jitters. And an end to the leveraged buyout boom, if that happens, could trigger layoffs on Wall Street and eat away at bonuses.

But the fiscal year is far enough along that financial services workers can expect gains of 10 to 15 percent when bonus season rolls around later this year, said Alan Johnson, the managing director of Johnson Associates, a Wall Street compensation consultant. The real pain, if there is any to be felt, would come in the 2008-09 bonus season, he said, and a year or two later for private equity firms, which typically make their profits several years after a takeover.

“Pay is going to probably drop, but if it’s dropping from a really, really high level, we’re probably not going to have any charity dinners for these people,” Mr. Johnson said.

By then, too, the flow of new development is expected to slow significantly, judging from the dwindling number of construction permits filed this year. To the extent Manhattan’s housing market is threatened by a weak national economy and by declining bonuses, said Mr. Miller of Miller Samuel, “then the fact that we have a lower level of supply coming on would help keep the market from correcting.”

Neil Binder, a principal in Bellmarc Realty and a 30-year industry veteran, typically views upturns with a jaundiced eye. But in a residential market with tight supply and intense demand, he doesn’t see Manhattan’s real estate karma changing anytime soon, even in the face of mortgage-market turmoil.

“My brokers are saying their biggest frustration is to have buyers when there’s no product and that there’s nothing out there but new construction,” Mr. Binder said. “We may have bumps, but I don’t feel the underpinnings are weakening. My biggest problem this month is that I have all my salespeople taking vacations because they made so much money. My East Side office is a ghost town.”

Monday, February 05, 2007

A Quick Guide to Property Titles

By JAY ROMANO

Published: February 4, 2007

When a husband and wife buy property, they usually take title as “tenants by the entirety.” With this form of ownership, each spouse owns an undivided 100 percent interest in the property.

Real estate lawyers say that married couples sometimes change the way they hold title to property to avoid or minimize estate taxes. But this strategy may not always be appropriate.

“I see this happen on a regular basis,” said Stanley Simon, a Manhattan lawyer who reviews co-op loans for lenders. “As the bank’s attorney, it’s not my place to tell people what they should or shouldn’t do. But I’m not sure that the people who are doing this have really thought it through.”

Mr. Simon said one of the benefits of holding title as tenants by the entirety is the ability to protect the property from creditors. He explained that when title is held as tenants in common — the form of ownership typically used by co-owners who are not married to each other — each owner’s interest belongs to that individual.

So with a tenancy in common, any owner can sell his or her interest to someone else, or if an owner dies, his or her share passes to heirs or beneficiaries. In addition, Mr. Simon said, any owner can petition a court to partition the property, a legal action that can result in a forced sale and distribution of the proceeds among the owners.

At the same time, Mr. Simon said, with a tenancy in common, if a creditor gets a judgment against an owner, that creditor also can ask a court to partition the property. In other words, the actions of one co-owner can result in the loss of the property by the other owner or owners.

But with title held in a tenancy by the entirety, when one spouse dies, the survivor automatically becomes the sole owner. And in New York, Mr. Simon said, a tenancy by the entirety cannot be partitioned by third parties. The practical effect of this is that if one spouse gets sued, the creditor cannot force a sale of the property.

“A tenancy by the entirety provides the best protection for the home,” Mr. Simon said.

There are, however, reasons that a married couple might want to hold title as tenants in common. William A. Cahill, Jr., an estate-planning lawyer in Brooklyn, said that under the federal tax law’s “marital deduction,” when property passes to one spouse upon the death of the other, no federal tax is due if the survivor is a United States citizen. In addition, he said, there is a federal exemption on the first $2 million of an estate left to anyone. So, if a home owned by a married couple is worth, say, $4 million, the property passes tax-free to the survivor when one spouse dies, regardless of how it is owned.

But when the second spouse dies, things get tricky. Since the federal exemption is $2 million, the value of the home above that amount — in this case, $2 million — is subject to tax when the property passes from the surviving spouse to beneficiaries.

Estate lawyers get around this, Mr. Cahill said, this way: instead of holding title as tenants by the entirety, a married couple owns as tenants in common. Then, the first spouse to die can pass his or her interest to the children in trust, allowing the survivor to remain in the property for life. And both spouses are able to take advantage of the $2 million exemption instead of one.

Ralph M. Engel, a Manhattan estate-planning lawyer, said that while a surviving joint owner may be able to renounce the interest owned by a deceased joint owner for tax purposes, it is generally more expedient to change the form of title ahead of time if estate taxes will be an issue. So, he said, property owners should carefully examine their financial situation to determine which form of ownership makes the most sense.

“Not everyone is going to get sued,” Mr. Engel said, “but we’re all going to die.”

Next Article in Real Estate (17 of 24) »

Published: February 4, 2007

When a husband and wife buy property, they usually take title as “tenants by the entirety.” With this form of ownership, each spouse owns an undivided 100 percent interest in the property.

Real estate lawyers say that married couples sometimes change the way they hold title to property to avoid or minimize estate taxes. But this strategy may not always be appropriate.

“I see this happen on a regular basis,” said Stanley Simon, a Manhattan lawyer who reviews co-op loans for lenders. “As the bank’s attorney, it’s not my place to tell people what they should or shouldn’t do. But I’m not sure that the people who are doing this have really thought it through.”

Mr. Simon said one of the benefits of holding title as tenants by the entirety is the ability to protect the property from creditors. He explained that when title is held as tenants in common — the form of ownership typically used by co-owners who are not married to each other — each owner’s interest belongs to that individual.

So with a tenancy in common, any owner can sell his or her interest to someone else, or if an owner dies, his or her share passes to heirs or beneficiaries. In addition, Mr. Simon said, any owner can petition a court to partition the property, a legal action that can result in a forced sale and distribution of the proceeds among the owners.

At the same time, Mr. Simon said, with a tenancy in common, if a creditor gets a judgment against an owner, that creditor also can ask a court to partition the property. In other words, the actions of one co-owner can result in the loss of the property by the other owner or owners.

But with title held in a tenancy by the entirety, when one spouse dies, the survivor automatically becomes the sole owner. And in New York, Mr. Simon said, a tenancy by the entirety cannot be partitioned by third parties. The practical effect of this is that if one spouse gets sued, the creditor cannot force a sale of the property.

“A tenancy by the entirety provides the best protection for the home,” Mr. Simon said.

There are, however, reasons that a married couple might want to hold title as tenants in common. William A. Cahill, Jr., an estate-planning lawyer in Brooklyn, said that under the federal tax law’s “marital deduction,” when property passes to one spouse upon the death of the other, no federal tax is due if the survivor is a United States citizen. In addition, he said, there is a federal exemption on the first $2 million of an estate left to anyone. So, if a home owned by a married couple is worth, say, $4 million, the property passes tax-free to the survivor when one spouse dies, regardless of how it is owned.

But when the second spouse dies, things get tricky. Since the federal exemption is $2 million, the value of the home above that amount — in this case, $2 million — is subject to tax when the property passes from the surviving spouse to beneficiaries.

Estate lawyers get around this, Mr. Cahill said, this way: instead of holding title as tenants by the entirety, a married couple owns as tenants in common. Then, the first spouse to die can pass his or her interest to the children in trust, allowing the survivor to remain in the property for life. And both spouses are able to take advantage of the $2 million exemption instead of one.

Ralph M. Engel, a Manhattan estate-planning lawyer, said that while a surviving joint owner may be able to renounce the interest owned by a deceased joint owner for tax purposes, it is generally more expedient to change the form of title ahead of time if estate taxes will be an issue. So, he said, property owners should carefully examine their financial situation to determine which form of ownership makes the most sense.

“Not everyone is going to get sued,” Mr. Engel said, “but we’re all going to die.”

Next Article in Real Estate (17 of 24) »

Monday, January 29, 2007

By VIVIAN S. TOY

Published: January 28, 2007

RENÉE MIZRAHI suspects that the first real estate agent she worked with deliberately didn’t tell her that a building was only 49 percent owner-occupied.

Her bank subsequently refused to give her a mortgage, and she lost the apartment.

Her second broker was worse. He stood her up at an apartment showing, she said, and he lied about the building’s financial requirements and about having put in her bid for the co-op. Then when she told him that she didn’t want to work with him anymore, he kept calling her — she has caller ID — and hanging up without leaving a message. “So he was like stalking me,” Ms. Mizrahi said. “What a nightmare!”

She is now working with a broker, referred by a friend, with whom she feels comfortable, but her bad broker experiences have nonetheless made her wonder if any broker can really be trusted. “I just want to work with someone who shows up when they say they will and who will tell me the information I need,” she said. “Why is this so hard?”

Ms. Mizrahi is not alone in her hard-earned broker wariness.

A Harris poll conducted last year that ranked occupations in terms of prestige placed real estate brokers at the very bottom of a list of 23 professions. (Firefighters and doctors were at the top.)

Brokers themselves seem well aware that their business isn’t always held in very high regard. The National Association of Realtors has an advertising campaign called “Someone You Can Trust,” which stresses that Realtors are subject to mandatory ethics training. “Not many professionals can claim that on their résumé,” the ads read.

Svetlana Choi, a senior sales associate at Bellmarc Realty, estimated that at least a quarter of her clients are skeptical when they first come to her.

“I just try to draw them out and relate to them in a way that lets them know that I’m not the enemy,” she said. “I’m not trying to snow them. I’m really just trying to be helpful.”

So why do people often have trouble trusting a broker?

To start with, brokers are salespeople, so buyers with suspicious minds would naturally suspect brokers of trying to sell them something they don’t necessarily want or need. But brokers also admit that some real estate agents help to perpetuate stereotypes with classic bait-and-switch schemes and by putting their own desires to close a deal over a client’s best interests. The fact that brokers themselves sometimes find it hard to trust one another only compounds the level of suspicion in real estate.

There are two major sources of broker-to-broker mistrust. The first is the fear that one broker may be trying to poach another’s client. The second is that a seller’s broker may be deliberately avoiding phone calls or refusing to submit an offer because he or she wants to avoid having to share the commission. The cynicism may well stem from the fiercely competitive marketplace and the fact that there are more than 28,700 brokers and sales agents in Manhattan alone and 66,700 in all five boroughs.

Erik Serras, a sales agent at Pari Passu Realty in Manhattan, said another agent recently stood outside an open house that Mr. Serras was holding just to hand out his business card. “It was the equivalent of ambulance chasing, and it sheds a negative light on the industry on the whole,” he said. “There are just too many untrained agents out there doing things that are unethical and unprofessional, and once a client is exposed to that, the damage is done because it’s easy for people to generalize.”

Ann Rothman, a Bellmarc agent, said that some people were quick to judge brokers because they “just have a queasy feeling about real estate.” She added that she sometimes finds herself saying, “I do real estate, so yes, I sell used cars, and people are going to think the speedometer has been changed.”

But Ms. Rothman tries to be philosophical about it. “Any person in a service business is going to be up against that,” she said. “Even if you go to a doctor or a dentist, there are going to be people who think they’re only doing a procedure because they have their kid’s college education or a trip to finance.”

When she comes across skeptical clients, Ms. Rothman said, “I’ll bring it up, and I’ll say, ‘What’s the problem here?’ ” That seems to work, she added, citing as proof an entire family of doubting buyers. “They all have a distrust gene,” she said, “but they keep referring other family members to me.”

Another instance when a broker might appear to be evasive is at an open house. When brokers hold open houses, they represent the sellers, but they also routinely use the events as an opportunity to pick up other clients. So if a potential buyer walks in and doesn’t seem right for that particular apartment, the broker can offer to help the buyer find something else. But under the unwritten rules of the game, the broker does not have to disclose whether there are any other open houses in the same building, particularly if the events are being held by competing firms.

These kinds of situations can easily lead to mistrust on the part of sellers and buyers alike.

Managers at real estate agencies say that the only way to minimize misunderstandings is to train new agents to be highly professional and to establish and enforce industry standards. To that end, the Real Estate Board of New York has established a list of 17 resolutions aimed at addressing ethical questions in residential real estate.

The resolutions cover issues as basic as the definition of an “exclusive” and the need to have backup brokers available when the exclusive broker is not available. They also try to cut down on typical broker squabbles by declaring it improper to foist a business card on someone else’s client and asserting that brokers should give co-brokers and their customers at least 20 minutes’ grace time if they’re late for an appointment.

Diane Ramirez, the president of Halstead Property and a governor of the real estate board, said, “Some of these things may seem silly, but it creates a framework of proper decorum.”

The board and its policies have evolved to make it clearer that “we are an industry that works for our sellers and buyers, and that should be our primary goal,” Ms. Ramirez said. “That’s the only way to dispel the distrust that comes in, not because it’s earned but because of what our reputation may have been.”

The real estate board also has an ethics committee that handles complaints filed by brokers against other brokers. Stephen Kliegerman, Halstead’s executive director for development marketing and a former chairman of the ethics committee, said the committee handles only a handful of cases each year, but he added that most complaints do not get to the board because agency managers tend to resolve complaints among themselves.

One of the biggest current complaints involves brokers who post listings on their Web sites for the exclusive properties of other brokers. “They’ll advertise a property they don’t represent, or sometimes the property doesn’t even exist,” Mr. Kliegerman said. “So when the buyer calls, it’s a bait-and-switch — the broker knows nothing about the property and winds up trying to take them to something completely different.”

He said the ethics committee is developing a new resolution to deal with the problem. “This kind of thing happens daily, and it taints the consumer’s impression of the entire broker community,” he said.

Consumers can file complaints about real estate agents with the Department of State in New York, the Real Estate Commission in New Jersey and the Department of Consumer Protection in Connecticut.

The New York Department of State can punish agents for infractions ranging from practicing without a license to a catchall category labeled “untrustworthiness and incompetency.” The latter can include things like lying about the school district for a particular address or misleading a buyer about future development in the area.

If the number of complaints filed in New York in recent years is any indication, brokers may actually be becoming more trustworthy. From 2001 to 2005, the last year with complete statistics, the annual number of complaints declined from 1,589 to 1,176.

The complaint category that showed the sharpest drop and that accounts for most of the decline was in “agency disclosure,” indicating that real estate agents have gotten better at disclosing whether they are a seller’s broker or buyer’s broker and what that means in terms of where their loyalty lies.

Of the completed cases from 2005, 109 real estate agents were fined, 3 had their licenses suspended, and 14 had their licenses revoked. Fines can run as high as $1,000, and suspension periods are determined on a case-by-case basis.

But most ethical breaches probably never reach either the real estate board or the Department of State. Ms. Rothman of Bellmarc recalled a case in which she represented a buyer who made an all-cash, full-price offer on an apartment, only to have the seller’s agent stall and falsely claim that the sellers wanted time to consider the offer.

“I later found out that he was waiting for a customer of his own to make an offer and he never even told the sellers about my offer,” she said. She filed a complaint with the other agent’s manager, and her buyers eventually got the apartment.

When training new agents, larger real estate companies stress the need for proper broker etiquette, both with clients and with other brokers.

Vasco Da Silva, the director of sales at Halstead’s Riverdale office, says Halstead’s broker boot camp tells agents when they should keep their business cards in their pockets, advises them to turn off cellphones while showing an apartment and instructs them never to talk about an apartment inside an elevator if there are other people around.

“We go through a logical step-by-step process, and it’s all about winning a customer’s loyalty and trust,” he said. “You don’t get it with your first meeting, so what you have to do is win your customers over with service and with confidence in your ability.”

In its training, Bellmarc urges new agents to be as straightforward as possible and to avoid pushing an apartment on a reluctant customer. “If someone doesn’t want an apartment, you don’t want to try to talk them into it,” said Janice Silver, an executive vice president at Bellmarc. “You can’t say, ‘But it’s fabulous — here’s why you should buy it.’ ”

Instead, she trains agents to ask simple questions like: Do you like this apartment? Can you see yourself living here? Do you want to buy this?

“Don’t be pushy, but be very direct,” she said. “Because if they don’t like the apartment, you should move on and not waste everybody’s time.”

Some brokers say their colleagues should not try to hide a property’s blemishes. Jill Sloane, a senior vice president at Halstead who is Ms. Mizrahi’s new broker, said she once represented a seller whose apartment came with a 33 percent flip tax, and she made a point of including that in her advertising materials.

“There was no point in hiding something like that because buyers would eventually find out about it anyway,” she said. “It’s just not worth the damage it would do to your reputation to be deceptive.”

Patricia Warburg Cliff, a senior vice president of the Corcoran Group, agreed. “If I know that there’s a bus that idles under the living room window, I have to get it out first thing,” she said. “Because if a buyer finds out about it midway into a transaction, you have egg all over your face, and the seller isn’t served because they’re not out to swindle someone.”

Sometimes, even when a transaction provides a happy ending for everyone, a buyer can still be left with lingering doubts about the broker and his or her motives.

Take Rob and Lauren Mank, who are now happily living in an Upper West Side apartment they bought last year. Mr. Mank said they had no qualms about their agent, a buyers’ broker, until final negotiations, when she pushed them to offer the full asking price, which would have meant raising their bid by $45,000. They ultimately went up by $35,000 and got the apartment because two competing buyers did not raise their bids.

“I felt like it was very high pressure and her loyalty to us was compromised by her desire to do the deal,” he said. “It left us with a bad taste.”

But Ms. Mank said she didn’t believe there was any malice involved and noted that without a crystal ball, there is no way of knowing if they could have gotten the apartment for less.

“Maybe you’re always going to want to blame someone for some infraction because you’re always going to feel taken advantage of in some way,” she said. “It’s a delicate and intimate situation because it’s your home and it’s your finances — the whole thing is just so fraught.”

Published: January 28, 2007

RENÉE MIZRAHI suspects that the first real estate agent she worked with deliberately didn’t tell her that a building was only 49 percent owner-occupied.

Her bank subsequently refused to give her a mortgage, and she lost the apartment.

Her second broker was worse. He stood her up at an apartment showing, she said, and he lied about the building’s financial requirements and about having put in her bid for the co-op. Then when she told him that she didn’t want to work with him anymore, he kept calling her — she has caller ID — and hanging up without leaving a message. “So he was like stalking me,” Ms. Mizrahi said. “What a nightmare!”

She is now working with a broker, referred by a friend, with whom she feels comfortable, but her bad broker experiences have nonetheless made her wonder if any broker can really be trusted. “I just want to work with someone who shows up when they say they will and who will tell me the information I need,” she said. “Why is this so hard?”

Ms. Mizrahi is not alone in her hard-earned broker wariness.

A Harris poll conducted last year that ranked occupations in terms of prestige placed real estate brokers at the very bottom of a list of 23 professions. (Firefighters and doctors were at the top.)

Brokers themselves seem well aware that their business isn’t always held in very high regard. The National Association of Realtors has an advertising campaign called “Someone You Can Trust,” which stresses that Realtors are subject to mandatory ethics training. “Not many professionals can claim that on their résumé,” the ads read.

Svetlana Choi, a senior sales associate at Bellmarc Realty, estimated that at least a quarter of her clients are skeptical when they first come to her.

“I just try to draw them out and relate to them in a way that lets them know that I’m not the enemy,” she said. “I’m not trying to snow them. I’m really just trying to be helpful.”

So why do people often have trouble trusting a broker?

To start with, brokers are salespeople, so buyers with suspicious minds would naturally suspect brokers of trying to sell them something they don’t necessarily want or need. But brokers also admit that some real estate agents help to perpetuate stereotypes with classic bait-and-switch schemes and by putting their own desires to close a deal over a client’s best interests. The fact that brokers themselves sometimes find it hard to trust one another only compounds the level of suspicion in real estate.

There are two major sources of broker-to-broker mistrust. The first is the fear that one broker may be trying to poach another’s client. The second is that a seller’s broker may be deliberately avoiding phone calls or refusing to submit an offer because he or she wants to avoid having to share the commission. The cynicism may well stem from the fiercely competitive marketplace and the fact that there are more than 28,700 brokers and sales agents in Manhattan alone and 66,700 in all five boroughs.

Erik Serras, a sales agent at Pari Passu Realty in Manhattan, said another agent recently stood outside an open house that Mr. Serras was holding just to hand out his business card. “It was the equivalent of ambulance chasing, and it sheds a negative light on the industry on the whole,” he said. “There are just too many untrained agents out there doing things that are unethical and unprofessional, and once a client is exposed to that, the damage is done because it’s easy for people to generalize.”

Ann Rothman, a Bellmarc agent, said that some people were quick to judge brokers because they “just have a queasy feeling about real estate.” She added that she sometimes finds herself saying, “I do real estate, so yes, I sell used cars, and people are going to think the speedometer has been changed.”

But Ms. Rothman tries to be philosophical about it. “Any person in a service business is going to be up against that,” she said. “Even if you go to a doctor or a dentist, there are going to be people who think they’re only doing a procedure because they have their kid’s college education or a trip to finance.”

When she comes across skeptical clients, Ms. Rothman said, “I’ll bring it up, and I’ll say, ‘What’s the problem here?’ ” That seems to work, she added, citing as proof an entire family of doubting buyers. “They all have a distrust gene,” she said, “but they keep referring other family members to me.”

Another instance when a broker might appear to be evasive is at an open house. When brokers hold open houses, they represent the sellers, but they also routinely use the events as an opportunity to pick up other clients. So if a potential buyer walks in and doesn’t seem right for that particular apartment, the broker can offer to help the buyer find something else. But under the unwritten rules of the game, the broker does not have to disclose whether there are any other open houses in the same building, particularly if the events are being held by competing firms.

These kinds of situations can easily lead to mistrust on the part of sellers and buyers alike.

Managers at real estate agencies say that the only way to minimize misunderstandings is to train new agents to be highly professional and to establish and enforce industry standards. To that end, the Real Estate Board of New York has established a list of 17 resolutions aimed at addressing ethical questions in residential real estate.

The resolutions cover issues as basic as the definition of an “exclusive” and the need to have backup brokers available when the exclusive broker is not available. They also try to cut down on typical broker squabbles by declaring it improper to foist a business card on someone else’s client and asserting that brokers should give co-brokers and their customers at least 20 minutes’ grace time if they’re late for an appointment.

Diane Ramirez, the president of Halstead Property and a governor of the real estate board, said, “Some of these things may seem silly, but it creates a framework of proper decorum.”

The board and its policies have evolved to make it clearer that “we are an industry that works for our sellers and buyers, and that should be our primary goal,” Ms. Ramirez said. “That’s the only way to dispel the distrust that comes in, not because it’s earned but because of what our reputation may have been.”

The real estate board also has an ethics committee that handles complaints filed by brokers against other brokers. Stephen Kliegerman, Halstead’s executive director for development marketing and a former chairman of the ethics committee, said the committee handles only a handful of cases each year, but he added that most complaints do not get to the board because agency managers tend to resolve complaints among themselves.

One of the biggest current complaints involves brokers who post listings on their Web sites for the exclusive properties of other brokers. “They’ll advertise a property they don’t represent, or sometimes the property doesn’t even exist,” Mr. Kliegerman said. “So when the buyer calls, it’s a bait-and-switch — the broker knows nothing about the property and winds up trying to take them to something completely different.”

He said the ethics committee is developing a new resolution to deal with the problem. “This kind of thing happens daily, and it taints the consumer’s impression of the entire broker community,” he said.

Consumers can file complaints about real estate agents with the Department of State in New York, the Real Estate Commission in New Jersey and the Department of Consumer Protection in Connecticut.

The New York Department of State can punish agents for infractions ranging from practicing without a license to a catchall category labeled “untrustworthiness and incompetency.” The latter can include things like lying about the school district for a particular address or misleading a buyer about future development in the area.

If the number of complaints filed in New York in recent years is any indication, brokers may actually be becoming more trustworthy. From 2001 to 2005, the last year with complete statistics, the annual number of complaints declined from 1,589 to 1,176.

The complaint category that showed the sharpest drop and that accounts for most of the decline was in “agency disclosure,” indicating that real estate agents have gotten better at disclosing whether they are a seller’s broker or buyer’s broker and what that means in terms of where their loyalty lies.

Of the completed cases from 2005, 109 real estate agents were fined, 3 had their licenses suspended, and 14 had their licenses revoked. Fines can run as high as $1,000, and suspension periods are determined on a case-by-case basis.

But most ethical breaches probably never reach either the real estate board or the Department of State. Ms. Rothman of Bellmarc recalled a case in which she represented a buyer who made an all-cash, full-price offer on an apartment, only to have the seller’s agent stall and falsely claim that the sellers wanted time to consider the offer.

“I later found out that he was waiting for a customer of his own to make an offer and he never even told the sellers about my offer,” she said. She filed a complaint with the other agent’s manager, and her buyers eventually got the apartment.

When training new agents, larger real estate companies stress the need for proper broker etiquette, both with clients and with other brokers.

Vasco Da Silva, the director of sales at Halstead’s Riverdale office, says Halstead’s broker boot camp tells agents when they should keep their business cards in their pockets, advises them to turn off cellphones while showing an apartment and instructs them never to talk about an apartment inside an elevator if there are other people around.

“We go through a logical step-by-step process, and it’s all about winning a customer’s loyalty and trust,” he said. “You don’t get it with your first meeting, so what you have to do is win your customers over with service and with confidence in your ability.”

In its training, Bellmarc urges new agents to be as straightforward as possible and to avoid pushing an apartment on a reluctant customer. “If someone doesn’t want an apartment, you don’t want to try to talk them into it,” said Janice Silver, an executive vice president at Bellmarc. “You can’t say, ‘But it’s fabulous — here’s why you should buy it.’ ”

Instead, she trains agents to ask simple questions like: Do you like this apartment? Can you see yourself living here? Do you want to buy this?

“Don’t be pushy, but be very direct,” she said. “Because if they don’t like the apartment, you should move on and not waste everybody’s time.”

Some brokers say their colleagues should not try to hide a property’s blemishes. Jill Sloane, a senior vice president at Halstead who is Ms. Mizrahi’s new broker, said she once represented a seller whose apartment came with a 33 percent flip tax, and she made a point of including that in her advertising materials.

“There was no point in hiding something like that because buyers would eventually find out about it anyway,” she said. “It’s just not worth the damage it would do to your reputation to be deceptive.”

Patricia Warburg Cliff, a senior vice president of the Corcoran Group, agreed. “If I know that there’s a bus that idles under the living room window, I have to get it out first thing,” she said. “Because if a buyer finds out about it midway into a transaction, you have egg all over your face, and the seller isn’t served because they’re not out to swindle someone.”

Sometimes, even when a transaction provides a happy ending for everyone, a buyer can still be left with lingering doubts about the broker and his or her motives.

Take Rob and Lauren Mank, who are now happily living in an Upper West Side apartment they bought last year. Mr. Mank said they had no qualms about their agent, a buyers’ broker, until final negotiations, when she pushed them to offer the full asking price, which would have meant raising their bid by $45,000. They ultimately went up by $35,000 and got the apartment because two competing buyers did not raise their bids.

“I felt like it was very high pressure and her loyalty to us was compromised by her desire to do the deal,” he said. “It left us with a bad taste.”

But Ms. Mank said she didn’t believe there was any malice involved and noted that without a crystal ball, there is no way of knowing if they could have gotten the apartment for less.

“Maybe you’re always going to want to blame someone for some infraction because you’re always going to feel taken advantage of in some way,” she said. “It’s a delicate and intimate situation because it’s your home and it’s your finances — the whole thing is just so fraught.”

San Francisco

Average annual home price appreciation (1949-2006)*:4.2%

If developers were allowed to go all out with building on San Francisco's Treasure Island, Presidio and the Marin Headlands across the Golden Gate Bridge, the price of housing would fall close to the cost of construction. But those pristine natural amenities are the product of one of the most anti-development political cultures in the country - and a perennial magnet for the highest earners.

Los Angeles

Average annual home price appreciation (1949-2006)*: 3.7%

Along with San Francisco, Los Angeles was the first major metro in the United States to become "filled up” during the 1960s and 1970s because of geographic constraints and political restrictions on building. Three-quarters of new construction is now in-fill development, and much of it is high end. The gentrification is pricing out middle and lower income families, who are moving in-land.

Seattle

Average annual home price appreciation (1949-2006)*: 3.2%

The newest graduate to join this elite class of super-expensive cities, Seattle is the least likely to hold its place. New zoning laws approved by the city council this year lift restrictions on building heights in the downtown core, and promise to generate $100 million worth of affordable housing.

Boston

Average annual home price appreciation (1949-2006)*:3.0%

Boston had the strongest wage growth of these cities through the tech bust and jobless recovery. Over the next five years, it will have the highest per capita income, next to San Francisco.

New York City

Average annual home price appreciation (1949-2006)*: 3.0%

The force with which middle class households here are getting replaced by wealthier ones was reflected in the recent hysteria over the Tishman Speyer group's $5.4-billion acquisition of 110 apartment buildings in lower Manhattan, the largest real estate deal in recent history. The apartment blocks are home to thousands of rent-controlled tenants who should have been priced out of the city years ago - and fear they now will be by market rents under the new owner.

*National average: 2.3 percent

Average annual home price appreciation (1949-2006)*:4.2%

If developers were allowed to go all out with building on San Francisco's Treasure Island, Presidio and the Marin Headlands across the Golden Gate Bridge, the price of housing would fall close to the cost of construction. But those pristine natural amenities are the product of one of the most anti-development political cultures in the country - and a perennial magnet for the highest earners.

Los Angeles

Average annual home price appreciation (1949-2006)*: 3.7%